|

| Collier County Public Schools Regular School Board Meeting – 5 PM Final Budget Hearing – 5:30 PM Tuesday, September 26 |

Should our school taxes go up or down next year? Should the District increase or decrease its spending on capital projects? On operations? These are among other matters our elected School Board members will decide Tuesday, so you have between now and then to have your say.

Some basics

School taxes are a function of the value of the properties subject to tax and a millage rate, which is a tax rate per $1,000 of assessed property value. The County Property Appraiser’s Office determines the assessed property values. The School Board decides the millage rate.

Local property taxes are just one source of a District’s funding. It also receives funds from the state and federal governments and a few non-governmental sources. A District has available to spend not only funds received in the current year but also funds it set aside as reserves in prior years.

At its first FY18 budget meeting in July…

At its first budget meeting on July 25 after hearing from five public speakers, the Board approved tentative 2017–18 millage rates and a tentative 2017–18 budget.

To begin, Superintendent Kamela Patton recommended millage rates that with the Property Appraiser’s estimate of property values would have yielded $437.6 million.

Board Vice Chair Erika Donalds then proposed reducing the Superintendent’s recommended millage for capital improvements, ultimately by 0.0200 mills, which would reduce taxes by $1.7 million. After discussion, the motion passed three to two, with Board members Stephanie Lucarelli and Erick Carter voting no.

The approved tentative millage rate of $5.1220 per $1,000 of assessed property value is 2.3 percent lower than last year’s $5.2450 per $1,000, as shown below.

Even though the rate is lower, because property values have increased it would yield $20.3 million more tax dollars, as shown below.

The state’s Truth in Millage (TRIM) law requires comparing the taxes that would be raised with the proposed millage rate to what would be raised with what it calls a “rolled-back rate.” The “rolled-back rate” is the millage rate that would have produced the same amount of tax dollars as the previous year, excluding new construction taxable values. Taxes raised with the proposed rate would be 2.02% higher than with the “rolled-back rate.”

At the July meeting, the Superintendent also recommended a tentative budget for the next school year of $1.051 billion, an increase of 7.6 percent over last year’s budget, based on a projected 46,529 students, up 1.5 percent from last year. That request was approved by a vote of four to one, with Board member Kelly Lichter the sole dissenter.

For approval Tuesday…

At the District’s final budget hearing/meeting Tuesday, the Superintendent will ask the Board to approve as final the previously-approved tentative rates totaling 5.1220 mills.

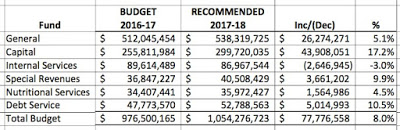

She will also ask them to approve as final a $1.054 billion budget. This amount is slightly more than the tentative budget they approved in July and 8 percent higher than last year, as shown below.

I assume but look forward to confirming on Tuesday that the recommended budget provides for costs associated with Hurricane Irma cleanup and repair. According to the Naples Daily News, Superintendent Patton said damage to schools was “minor, citing leaking roofs and missing tiles…. Twenty-seven district schools were used to shelter 17,000 people during and after the hurricane. In a Sept. 14 interview, Patton said she plans to submit expenses to FEMA and apply for county grants.”

How will the proposed millage rates impact the taxpayer?

According to the District’s draft budget presentation, a hypothetical taxpayer eligible for Florida’s Homestead Exemption whose property had an assessed value last year of $400,000 would have FY18 taxes of $1,964, a decrease of $3 (0.2%) compared to her prior year taxes.

If that taxpayer was not eligible for the Homestead Exemption, FY18 taxes on the same property would be $2,098, an increase $104 (5.0%).

I encourage you to preview Tuesday’s PowerPoint presentation here.

Conclusion

In this post, I tried to clearly and concisely summarize what I, who wants to be an informed voter, thought was important to know in advance of Tuesday’s budget meeting. I did not dig into the detailed budget and spending projections because I have confidence in Superintendent Patton and her team, and I have no interest in micro-managing or second-guessing them. For those who want more detail, it is available here.

In my opinion, given the impressive new academic offerings the District has and continues to introduce, the ongoing improvement in test scores, graduation rates, and school and district grades, the difficulty in attracting and retaining teachers, the continuing unfunded mandates from the state, and the projected increase in the number of students, the minimal proposed increase in the millage rate over the rolled-back rate is completely acceptable to me.

Let your voice be heard

The special School Board meeting to vote on the proposed final millage rates and budget is Tuesday, September 26, at 5:30 PM at the Dr. Martin Luther King Administrative Center, 5775 Osceola Center, Naples, FL.

Let your voice be heard if you have input you would like considered before the Board votes. Attend the meeting in person or contact any/all School Board members before the meeting.

Erick Carter – cartee1@collierschools.com

Erika Donalds – donale@collierschools.com

Kelly Lichter – lichteke@collierschools.com

Stephanie Lucarelli – lucars@collierschools.com

Roy Terry – terryro@collierschools.com

And also ….

In addition to the budget, the Board will consider several other important matters at its regular monthly meeting beginning at 5 PM on Tuesday, including:

- Proposed 2018 Legislative Program of the Greater Florida Consortium of School Boards – The Board is requested to approve the proposed 2018 Legislative Program of the Greater Florida Consortium of School Boards as presented.

- Constitutional Challenge of HB 7069 – The General Counsel will review and discuss the claims and arguments that are anticipated to be alleged and advanced in the complaint to be filed by districts supporting challenging HB 7069 constitutionally.

- 2017-2018 Academic Calendar Adjustments – The Board is requested to approve the 2017-2018 Academic School calendar adjustments due to Hurricane Irma.

The agenda and related materials for Tuesday’s Regular School Board meeting are here.