Collier County’s Final Budget Hearing began yesterday afternoon at 5:05 p.m. There were about 70 public speakers, both in person and via Zoom. The meeting ended around 1:30 a.m. this morning. The video recording of the meeting became available on the county website around 10 a.m. this morning; watch it here.

In this post, I summarize what happened at the meeting. I assume you read my prior post, Conservation Collier and the 2024 County Budget, so I won’t repeat any of the background or links to documents I provided there.

The Tax Rate

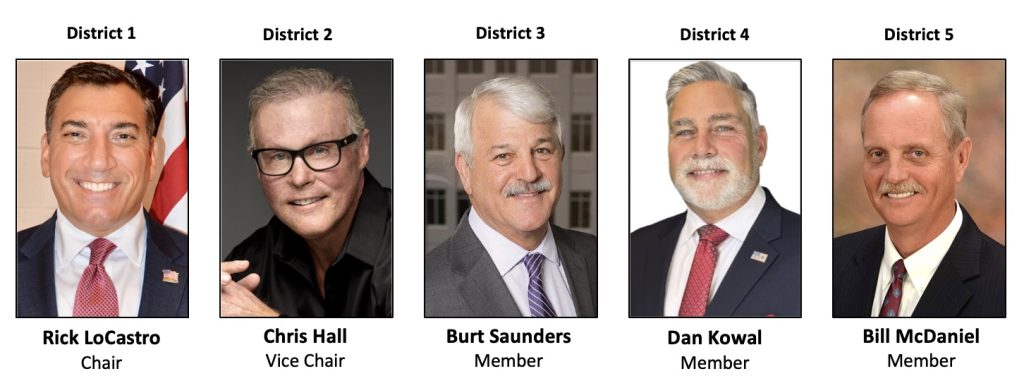

By a vote of 4 to 1, Collier County commissioners adopted the rolled-back rate for the countywide General Fund, the Unincorporated Area General Fund, the Water Pollution Control Fund, and Conservation Collier. Commissioner Burt Saunders was the sole no vote.

As a result, taxpayers will not have an increase in the county government portion of their property tax bill for 2024. There will still be an increase in their total tax bill, however, since the Collier County School Board passed a budget with a millage rate 10.66 percent greater than the rolled-back rate. (Naples Daily News, 9/15/23) And residents of some MSTUs will also see increases.

Under the rolled-back rate, Conservation Collier will receive $31.1 million, compared with the $34.7 million it would have received at the millage-neutral 0.25 mills that was in the tentative budget. It also leaves the county with a budget that is $62 million less than what is needed to fund the Tentative Budget based on budget policy and guidance commissioners agreed to in March.

The Discussion

Commissioner McDaniel raised the possibility of taking on outside borrowing to fund some of the shortfall. But Comptroller Crystal Kinzel said borrowing made no sense in the current high-interest rate environment.

Commissioners were told that land acquisitions by Conservation Collier over the past two years totaled $5 million and that spending from the maintenance endowment this year was about $1.4 million.

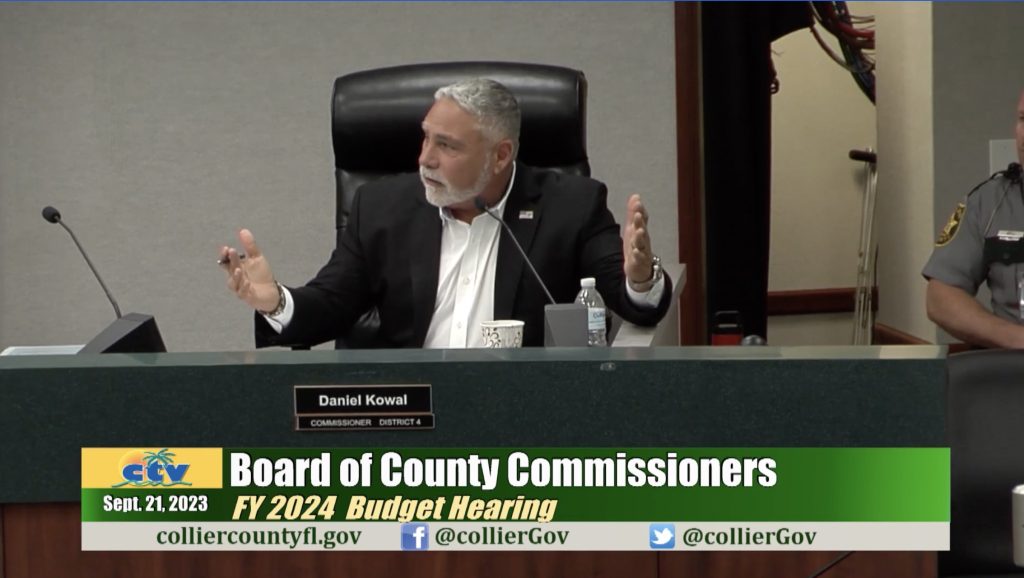

Commissioner Kowal said there is $48 million in a bank account earning interest that “we’re not even touching.” He was referring to unspent Conservation Collier funds that had been collected in prior years. He suggested that, given the current rate of spending, the county could use some of that money now and replenish it later.

As noted above, the rolled-back rate would raise $62 million less than the millage-neutral rate and leave necessary county spending without funding.

Building on Kowal’s suggestion, McDaniel proposed using some of the Conservation Collier funds to make up the $62 million difference. Specifically, he suggested taking whatever amount is available in the Conservation Collier fund while still leaving it with $27 million for acquisitions and $10 million in the maintenance endowment fund.

Saunders strongly opposed the idea. He spoke several times about possible unintended consequences of the rolled-back rate for the county as a whole as well as for Conservation Collier. “We all know that [$10 million is] not enough for the future maintenance of the properties [Conservation Collier] already owns,” he said. “That’s just not a responsible way to deal for the future.”

No one used the words borrow or raid, but it seemed that that’s what they were talking about. Borrow would mean there is an intent to repay; raid would mean it’s gone for good. Kowal mentioned “replenishing” the fund but no repayment commitments were made nor was there talk of what the Conservation Collier millage rate would be in future years.

Staff’s Warnings

County Manager Amy Patterson and Deputy County Manager Ed Finn both cautioned that using a one-time infusion of funds for ongoing operating expenses was risky.

Further, “levying roll-back does not even keep up with inflation,” Finn said. “It’s essentially a spiral downward.”

Staff had previously agreed to explore zero-based budgeting as a way to reduce costs and streamline operations. In addition, rate studies are underway to look at fees charged for county services to ensure they cover costs. All said that much work will be needed to avoid even greater tax increases next year.

We will “look through every discretionary area we have, turn over every stone,” Patterson said.

Ultimately …

Ultimately, commissioners directed staff to do as McDaniel suggested.

If staff and commissioners don’t find the savings they are counting on from scrutinizing spending in the coming months, they will have some difficult decisions to make about the FY 2025 budget and tax rates in the months leading up to next year’s elections with respect to the level of services we have come to expect.

The terms of Commissioners LoCastro (District 1), Saunders (District 3), and McDaniel (District 5) are up next year. As of now, LoCastro and Saunders have filed to run for another term.

All we can do now is wait — and see what happens.