Updated 9/24/23

The Board of County Commissioners is considering reducing the taxes it collects for the Conservation Collier Land Conservation Program next year as a way to lower Collier County residents’ tax bills. But voters overwhelmingly support Conservation Collier, as they showed at the ballot box in 2020, and any reduction is opposed by many who are aware of it. Unfortunately, many are not.

The Board will hear comments from the public and then decide on Conservation Collier funding as part of its approval of the FY 2024 tax rates and budget at a public budget hearing on Thursday, Sep. 21, beginning at 5:05 p.m. The meeting agenda and proposed budget materials will be available here.

In this post, I provide background on Conservation Collier and how it fits in with your property taxes and the bigger picture, with new Soapbox readers and Collier residents in mind. Next, I’ll summarize commissioners’ comments at previous budget meetings about the amount of Conservation Collier funding. And I will close with comments from members of the public who oppose the proposed reduction.

Conservation Collier

Some History

Conservation Collier is a taxpayer-funded land acquisition program (Program) created in 2003. It was initiated by the Board of County Commissioners (BCC) after voters overwhelmingly voted in a non-binding 2002 referendum to be taxed 0.25 mills a year for ten years to fund it. A 0.25 mill tax was collected under the Program each year between 2004 and 2013.

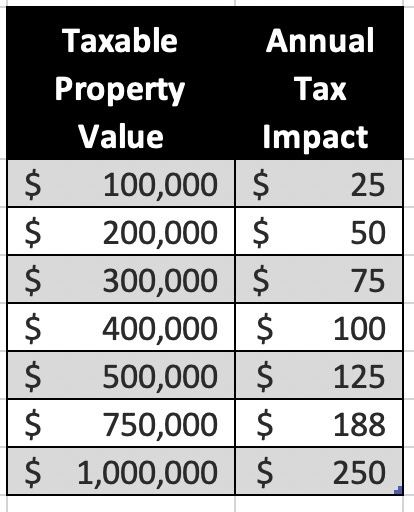

Millage is a tax rate defined as the “dollars charged for each $1,000 of value.” One mill equals one dollar of tax for every $1,000 of a property’s assessed value. One-quarter mill equals $25 for each $100,000 of taxable property value, or $75 for a $300K home, or $250 for a $1 million home.

A second “straw poll” referendum in 2006 asked voters whether they understood and approved that the Conservation Collier Program would be funded by a quarter mill ad valorem property tax for a period of ten (10) years, until 2013. Eighty-two percent (82%) of voters approved.

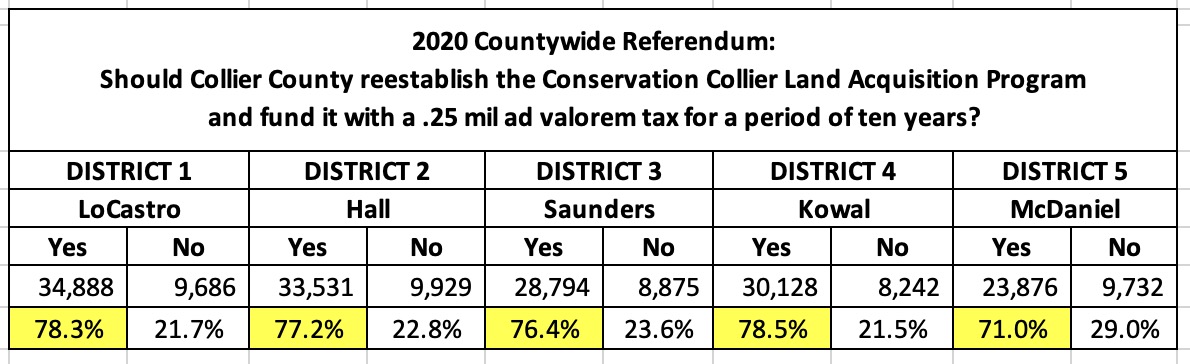

A third referendum in 2020 asked voters if the county should reestablish the Program and again fund it with a 0.25 mill ad valorem property tax for another ten years. See On the Ballot: Conservation Collier, Sparker’s Soapbox, 10/4/20.

That referendum also received overwhelming support, with the following numbers of votes cast in each of the five county commission districts:

The BCC subsequently voted unanimously to reestablish the Program and levy a 0.25 mill tax for 2021. For 2022 and 2023, the vote was 4 to 1 to continue the Program at the 0.25 mill rate; Commissioner McDaniel voted no.

And in 2024?

Based on a budget policy adopted by the BCC in March, a Tentative FY2024 Budget presented by county staff at a public budget hearing on Sep. 7 continued the countywide Conservation Collier tax levy of 0.25 mills. That rate would collect $34.7 million for the Program.

The Bigger Picture

The total Collier County budget totals nearly $2 billion. That includes the budgets for the Collier County School District, the county’s five elected constitutional officers, and more.

The amount controlled by the BCC represents about 26 percent of a typical resident’s tax bill. That portion of the budget is the subject of the current budget-setting process.

The Tentative County Budget

The Tentative FY2024 County Budget presented on Sep. 7 totaled $615.6 million. That amount is $72.7 million higher than last year’s adopted budget, $61.9 million higher than the rolled-back rate, and nearly $41 million higher than an amount based on the budget policy commissioners set at a meeting on Mar. 14 (Agenda Item 11.E.).

The rolled-back rate is the tax rate that, given the higher taxable property value, would result in the same dollar amount of taxes as last year. According to Florida’s Truth in Millage (TRIM) guidelines, a tax rate higher than the rolled-back rate is considered a tax increase.

Clearly, the budget reflects the increased costs that all of us are dealing with for utilities, insurance, goods and services, etc. It also includes a significant increase in the county’s pay plan, to address the fact that the county has been losing staff and is unable to recruit to replace them because of what the county manager called a “very, very aged” pay plan.

In addition, the increase reflects the higher taxable property values to which the proposed millage rates were applied.

The countywide taxable property value for FY 2024 is roughly $138.7 billion, an increase of $16.6 billion over the prior year. Of the increase, about $2.8 billion is due to new construction; the balance is due to increased market value.

In June, the Naples Daily News reported that Collier County’s property values were preliminarily up more than 18.5 percent over last year and that excluding new construction, property values still rose by 16.8 percent countywide.

Where to Cut?

After staff’s presentation of the tentative budget on Sep. 7, Commissioner Kowal spoke aggressively in favor of reducing the Conservation Collier budget. The program is not a requirement, he said. It’s a wish. He wants to fund it at the rolled-back rate of 0.2242 mills or even less. Other commissioners agreed with the need to find ways to spend less.

View the Sep. 7 presentation and Board discussion here, beginning at 2:34.

After the presentation, public comments, and discussion, commissioners asked staff to develop a list of potential budget or millage rate reductions and add them to the agenda for their Sep. 12 meeting.

Staff Suggestions

At the Sep. 12 BCC meeting, Deputy County Manager Ed Finn reviewed a list of 31 potential budget reductions totaling $31 million. The list included the amount by which Conservation Collier at 0.25 mills exceeded the budget policy adopted in March ($2.3 million), an expanded stormwater swale maintenance program ($2.8 million), additional stormwater capital ($2.5 million), and increased reserves ($18.1 million).

View the Sep. 12 presentation and Board discussion here, beginning at 3:22.

Back to Conservation Collier

Finn then reviewed the Conservation Collier Program in detail. He showed that the latest projected collections over the Program’s 10-year life at the 0.25 mill rate ($353.3 million) exceeded the amount projected when the Program went to the ballot ($284.9 million) by $68.4 million. The increase is based on two years of collections thus far and what was budgeted for the current year.

He said if that initial projection was the 10-year Program funding goal and considering what has been collected to date, then the required tax levy for each of the remaining eight years of the program would be $28.6 million. That amount is $6 million less than the proposed taxes that would be collected at 0.25 mills.

Board Majority Supports < 0.25 Mill for Conservation Collier

To sum up the Board’s lengthy discussion on Sep. 12: Commissioners LoCastro, Hall, Kowal, and McDaniel support reducing the Conservation Collier millage rate to something below 0.25 mill to reduce the overall budget and individual tax bills.

LoCastro directed the County Manager to bring back to the Final Budget Hearing a budget with $14 million less in the Conservation Collier budget (i.e., about $20 million, down from the tentative $34.7 million). He said several times that this was not a “cut” in the Conservation Collier budget, but rather that “they were about to get a raise, and we’re not giving them that raise.”

According to my research, a $20 million budget would in fact be a substantial cut compared to prior years. Budgeted Conservation Collier tax dollars were $29.7 million in FY 2021, $26.2 million in FY 2022, and $30.6 million in FY 2023. (See adopted budgets for those years at Collier County Office of Management and Budget.)

Commissioner Saunders was the only commissioner who spoke in support of maintaining the overall county millage rate unchanged. “I have supported keeping the millage rate steady,” he said on Sep. 12. “I still do. Because I think that’s the best thing for the long-term future. Maybe that’s not the best thing for 2024. But I think it’s the best approach going forward in the long run.”

Opponents of the Millage Rate Cut

Brad Cornell spoke at the Sep. 12 meeting on behalf of the Audubon Society of the Western Everglades and Audubon Florida. He said Conservation Collier plays a “huge role… in the resilience, sustainability, and quality of life for our citizens,” and that it deserves “full funding.” He echoed a point made by Saunders that as Program revenues go up, so do costs, and that fact should not be ignored.

Others pointed out that once the Conservation Collier millage rate is reduced, any attempt to raise it back to 0.25 mill in the future would be a tax increase — something most commissioners vowed not to do. Therefore, they say, any reduction this year would effectively be permanent.

According to Meredith Budd, Director, External Affairs of the Live Wildly Foundation, “Over the course of the 10-year approved time span for the Program, the county would lose over $100 million dollars that otherwise could be spent to protect natural lands that benefit our water quality, provide habitat for important species, provide protection from major storm events and overall improve our quality of life.”

“Clearly the continued prosperity of the tourism, hospitality, real estate, and manufacturing industries of Collier County depend on maintaining an attractive environment,” wrote Alan and Carolyn Keller, Naples, in a letter to the editor. “Conservation Collier has been and remains one of the key interventions that county government can deploy to keep the area attractive for existing and new residents and businesses.”

Let Your Voice Be Heard

Chairman LoCastro said at last week’s meeting that he had had “minimal feedback” from the public about the budget. Commissioner Saunders said he received only four emails. Both said of the emails they received that half wanted no cuts in programs; the other half wanted tax cuts.

Readers, your emails, or lack thereof, are noticed!

Let your voice be heard. Do you want commissioners to reduce the Conservation Collier millage rate below 0.25 mill as a way to reduce your 2024 taxes? Remember, the proposed quarter-mill tax is the equivalent of $25/year for each $100K of taxable property value, or $75/year for a $300K home.

Email all five commissioners with your input on this important issue — and WHY you feel the way you do.

Dan.kowal@colliercountyfl.gov

Rick.LoCastro@colliercountyfl.gov

Chris.hall@colliercountyfl.gov

Bill.mcdaniel@colliercountyfl.gov

Burt.saunders@colliercountyfl.gov